Use the adjusted trial balance for stockton company – In the realm of accounting, the adjusted trial balance for Stockton Company stands as a pivotal document, offering a comprehensive snapshot of a company’s financial health. This guide delves into the intricacies of this essential tool, empowering readers with the knowledge to harness its full potential.

An adjusted trial balance is a modified version of the trial balance, incorporating adjustments to rectify errors and omissions, ensuring accuracy and completeness in financial reporting.

Overview of Adjusted Trial Balance

An adjusted trial balance is a financial statement that lists all of a company’s accounts and their balances after adjusting entries have been made. The purpose of an adjusted trial balance is to provide a snapshot of the company’s financial position at a specific point in time.

The steps involved in preparing an adjusted trial balance are as follows:

- Prepare a trial balance.

- Identify the adjustments that need to be made.

- Make the adjusting entries.

- Prepare an adjusted trial balance.

Adjustments to the Trial Balance

The types of adjustments that are typically made to the trial balance include:

- Accruals: Accruals are expenses that have been incurred but not yet paid, or revenues that have been earned but not yet received.

- Deferrals: Deferrals are expenses that have been paid but not yet incurred, or revenues that have been received but not yet earned.

- Depreciation and amortization: Depreciation and amortization are expenses that are used to allocate the cost of long-term assets over their useful lives.

- Impairments: Impairments are losses that are recognized when the fair value of an asset is less than its book value.

These adjustments are made to ensure that the financial statements reflect the true financial position of the company.

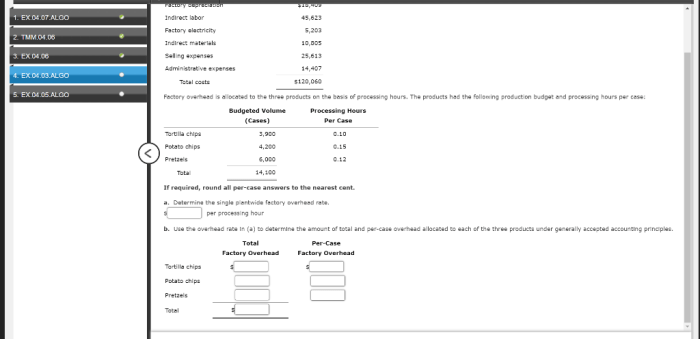

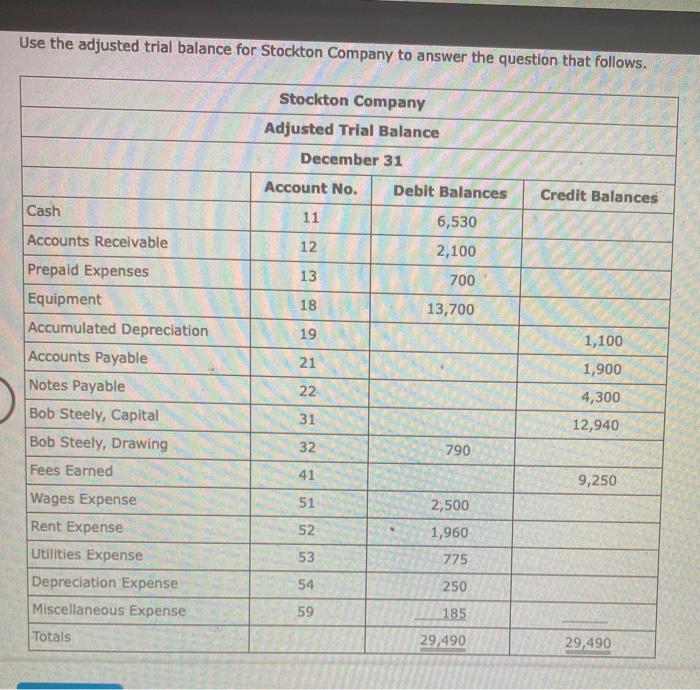

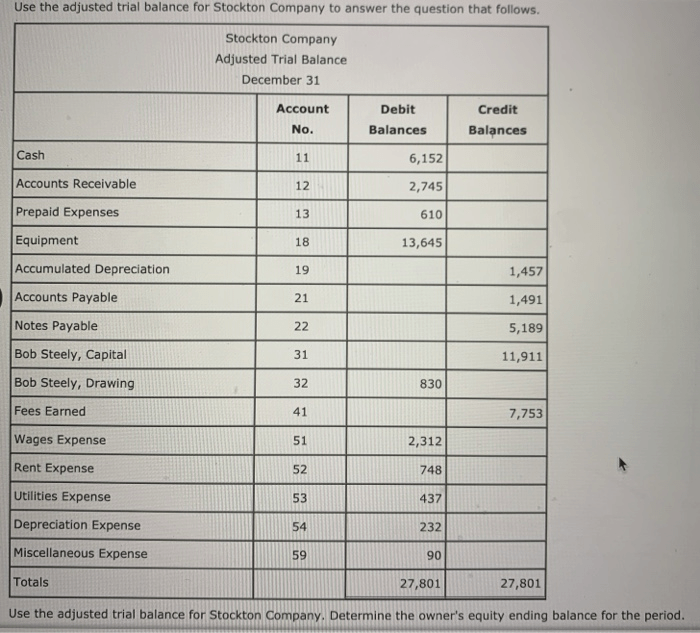

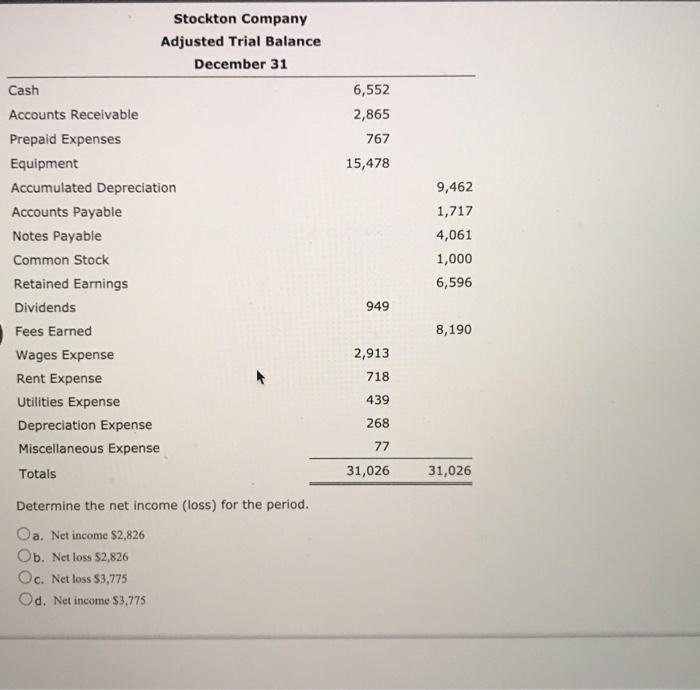

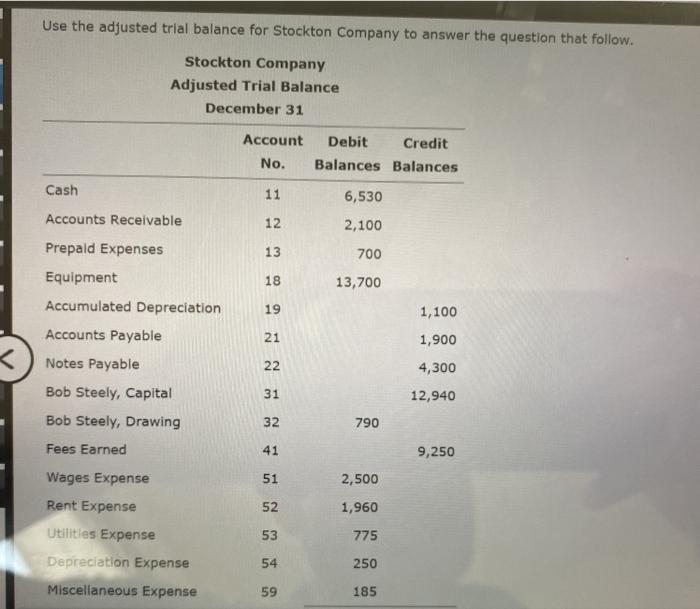

Stockton Company’s Adjusted Trial Balance

The following is an example of an adjusted trial balance for Stockton Company:

| Account | Debit | Credit |

|---|---|---|

| Cash | $10,000 | |

| Accounts receivable | 20,000 | |

| Inventory | 30,000 | |

| Prepaid insurance | 5,000 | |

| Property, plant, and equipment | 100,000 | |

| Accumulated depreciation | 20,000 | |

| Accounts payable | 15,000 | |

| Accrued expenses | 5,000 | |

| Unearned revenue | 10,000 | |

| Common stock | 50,000 | |

| Retained earnings | 25,000 | |

| Sales revenue | 100,000 | |

| Cost of goods sold | 60,000 | |

| Selling, general, and administrative expenses | 20,000 | |

| Interest expense | 5,000 | |

| Income tax expense | 10,000 | |

| Net income | 10,000 |

The adjusted trial balance shows the balances of all of Stockton Company’s accounts after adjusting entries have been made. This information can be used to prepare financial statements, such as the income statement and the balance sheet.

Using the Adjusted Trial Balance: Use The Adjusted Trial Balance For Stockton Company

The adjusted trial balance is used in the accounting cycle to prepare financial statements. The financial statements are used by investors, creditors, and other stakeholders to make decisions about the company.

The adjusted trial balance is also used to prepare tax returns. The tax returns are used by the government to calculate the amount of taxes that the company owes.

Essential Questionnaire

What is the purpose of an adjusted trial balance?

An adjusted trial balance corrects errors and omissions in the trial balance, ensuring accuracy and completeness in financial reporting.

How is an adjusted trial balance used in the accounting cycle?

The adjusted trial balance serves as a basis for preparing financial statements, including the income statement, balance sheet, and statement of cash flows.

What types of adjustments are typically made to the trial balance?

Common adjustments include accruals, deferrals, depreciation, and amortization, which rectify unrecorded transactions and events.