Identifying false statements about economic indicators is crucial for accurate economic analysis and decision-making. This article will delve into the topic of determine which statement below regarding economic indicators is false, exploring the types of economic indicators, their interpretation, and the limitations of using them.

Understanding the role of economic indicators in shaping economic policies and business strategies is essential. By examining false statements and clarifying their inaccuracies, we can enhance our ability to make informed decisions based on reliable economic data.

Economic Indicators: A Comprehensive Guide: Determine Which Statement Below Regarding Economic Indicators Is False

Economic indicators are statistical measures that provide insights into the performance of an economy. They help economists, policymakers, businesses, and individuals understand the current economic conditions and forecast future trends. Economic indicators can be broadly classified into two main types:

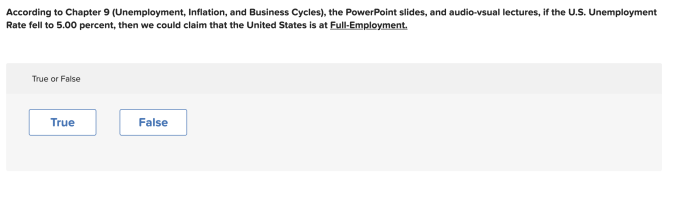

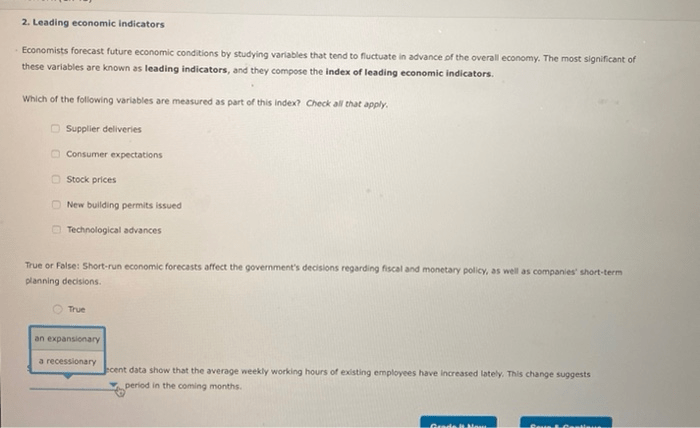

- Leading Indicators:These indicators provide a glimpse into the future direction of the economy. They are often used to predict economic turning points, such as recessions or expansions.

- Lagging Indicators:These indicators confirm economic trends that have already occurred. They are typically used to assess the current state of the economy and the impact of past policies.

Economic Indicator Interpretation

Economic indicators are interpreted by economists to assess the overall health of the economy. Indicators that show positive trends, such as increasing consumer spending or rising employment levels, are generally seen as signs of economic growth. Conversely, indicators that show negative trends, such as declining business investment or rising unemployment, may indicate economic weakness.The

significance of indicator trends and fluctuations lies in their ability to provide early warnings of potential economic problems or opportunities. By monitoring these indicators, economists can identify potential risks or growth areas and make informed recommendations for policy actions or business strategies.

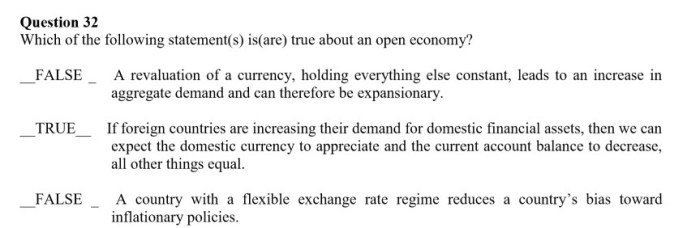

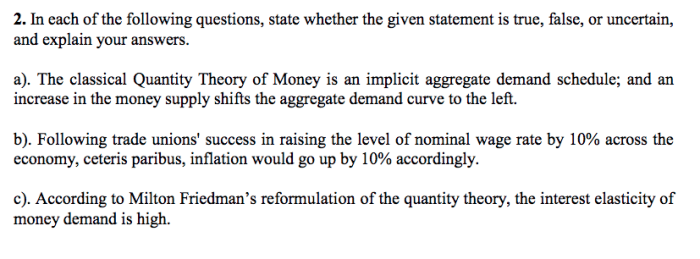

False Statements Regarding Economic Indicators, Determine which statement below regarding economic indicators is false

There are several false statements that are commonly made regarding economic indicators. These include:

- Economic indicators are always accurate:Economic indicators are based on data that is subject to errors and revisions. It is important to consider the potential for data inaccuracies or biases when interpreting economic indicators.

- A single economic indicator can provide a complete picture of the economy:No single economic indicator can fully capture the complexity of an economy. It is important to consider multiple indicators and data sources to get a comprehensive view of the economic landscape.

- Economic indicators are not useful for decision-making:Economic indicators provide valuable insights that can inform decision-making. Businesses, governments, and individuals can use economic indicators to make informed choices about investments, policy actions, and personal financial planning.

FAQ Explained

What are the different types of economic indicators?

Economic indicators can be classified into various types, including leading indicators, lagging indicators, and coincident indicators, each providing insights into different aspects of the economy.

How are economic indicators interpreted by economists?

Economists interpret economic indicators by analyzing their trends and fluctuations over time. They examine the relationships between different indicators to assess the overall health and direction of the economy.

What are the limitations of using economic indicators?

Economic indicators have limitations, such as data inaccuracies, biases, and the need to consider multiple indicators and data sources for a comprehensive analysis.