Welcome to the module 3 problem set ACC 201, an immersive journey into the fundamentals of accounting. This problem set is meticulously designed to equip you with the knowledge and skills essential for navigating the complexities of the accounting profession.

Through a series of engaging exercises and real-world examples, we will explore the core concepts and principles that underpin accounting practice. From understanding the basics of financial statements to applying advanced accounting techniques, this problem set will provide you with a solid foundation in the field.

Module 3 Problem Set Overview

The Module 3 Problem Set is designed to reinforce your understanding of the accounting principles and concepts covered in this module.

This problem set covers a range of topics, including:

Assets

- Definition and recognition of assets

- Classification of assets

- Measurement of assets

Liabilities

- Definition and recognition of liabilities

- Classification of liabilities

- Measurement of liabilities

Owners’ Equity

- Definition and components of owners’ equity

- Changes in owners’ equity

- Statement of owners’ equity

The Accounting Equation

- Understanding the accounting equation

- Using the accounting equation to analyze transactions

- Preparing a balance sheet using the accounting equation

Concepts and Principles

The Module 3 Problem Set revolves around the fundamental concepts and principles that underpin accounting practices. These concepts and principles provide a framework for understanding and interpreting financial information, ensuring its accuracy, reliability, and consistency.

The application of these concepts and principles in accounting practice is essential for producing financial statements that fairly and accurately represent an entity’s financial position and performance.

Accounting Equation

The accounting equation, Assets = Liabilities + Equity, is a cornerstone concept in accounting. It establishes the fundamental relationship between an entity’s assets, liabilities, and equity, providing a snapshot of its financial health.

Double-Entry Bookkeeping

Double-entry bookkeeping is a method of recording transactions that ensures the accounting equation remains balanced. Each transaction is recorded with dual entries, one debit and one credit, to maintain the equilibrium of the equation.

Time Period Assumption

The time period assumption divides the life of an entity into distinct periods, typically months or years. This allows for the preparation of financial statements at regular intervals, providing users with up-to-date information on the entity’s performance.

Going Concern Assumption

The going concern assumption presumes that an entity will continue to operate in the foreseeable future. This assumption is crucial for valuing assets and liabilities, as it assumes that the entity will have sufficient time to generate revenue and settle its obligations.

Matching Principle

The matching principle dictates that expenses should be recognized in the same period as the revenues they generate. This principle ensures that the income statement accurately reflects the entity’s performance for a given period.

Materiality Principle

The materiality principle states that only information that is significant to the financial statements should be disclosed. This principle helps to ensure that financial statements are concise and focused on the most important aspects of an entity’s financial position and performance.

Methods and Procedures

The problem set is designed to help you practice the methods and procedures used in accounting. These methods and procedures include:

- Recording transactions in a journal

- Posting journal entries to a ledger

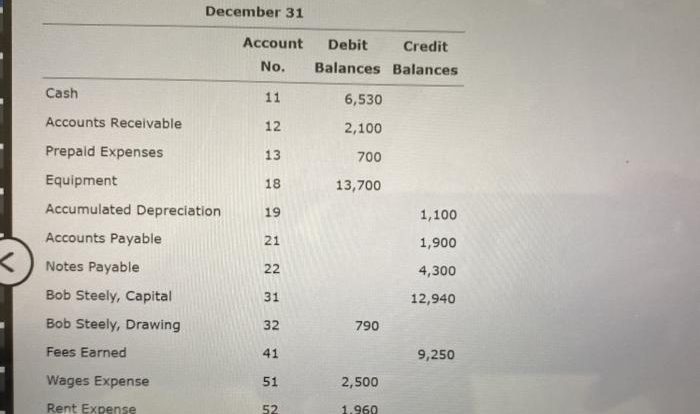

- Preparing a trial balance

- Adjusting the accounts

- Preparing financial statements

The following are examples of how these methods and procedures are applied:

Recording Transactions in a Journal

When a business transaction occurs, it is first recorded in a journal. The journal is a chronological record of all transactions. Each transaction is recorded on a separate line in the journal. The journal entry includes the date of the transaction, the account titles involved in the transaction, and the amount of the transaction.

Posting Journal Entries to a Ledger

After transactions have been recorded in the journal, they are posted to a ledger. The ledger is a collection of accounts that are used to track the balances of assets, liabilities, equity, revenues, and expenses. Each account in the ledger has a debit side and a credit side.

The debit side of an account is used to record increases in assets and expenses and decreases in liabilities, equity, and revenues. The credit side of an account is used to record decreases in assets and expenses and increases in liabilities, equity, and revenues.

Preparing a Trial Balance

A trial balance is a list of all the accounts in the ledger and their balances. The trial balance is used to check the accuracy of the accounting records. The total debits in the trial balance should equal the total credits.

Adjusting the Accounts

At the end of each accounting period, the accounts in the ledger must be adjusted. Adjusting entries are made to record transactions that have occurred but have not yet been recorded in the journal. Adjusting entries are also made to correct errors that have been made in the accounting records.

Preparing Financial Statements

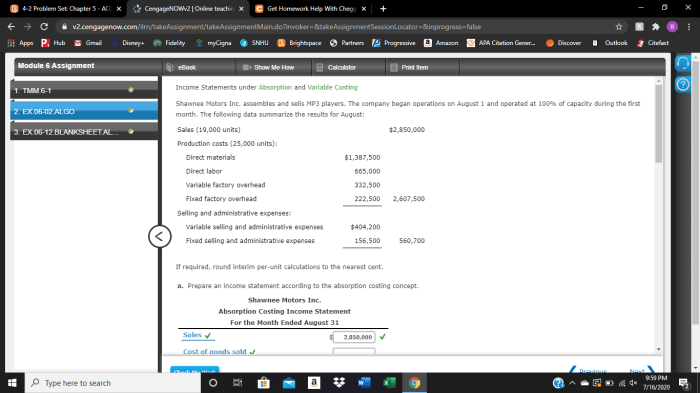

Financial statements are used to provide information about a business’s financial performance and position. The three main financial statements are the income statement, the balance sheet, and the statement of cash flows. The income statement shows a business’s revenues and expenses for a period of time.

The balance sheet shows a business’s assets, liabilities, and equity at a point in time. The statement of cash flows shows a business’s cash inflows and outflows for a period of time.

4. Examples and Applications

The concepts and methods covered in this problem set are widely used in the accounting profession. Here are some real-world examples:

Financial statement analysisis used to assess a company’s financial health and performance. It involves using ratios and other metrics to compare a company’s financial data to industry benchmarks or to its own historical data.

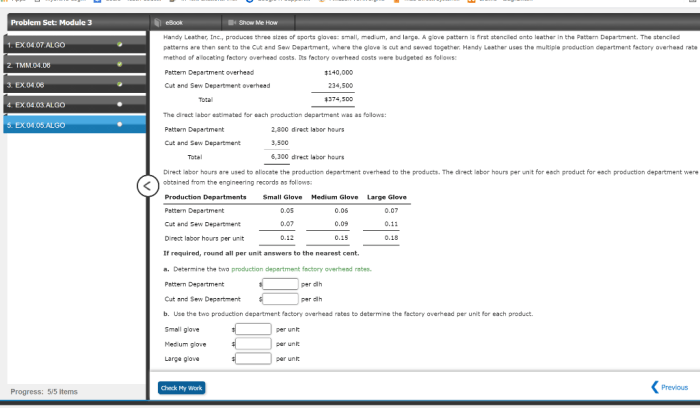

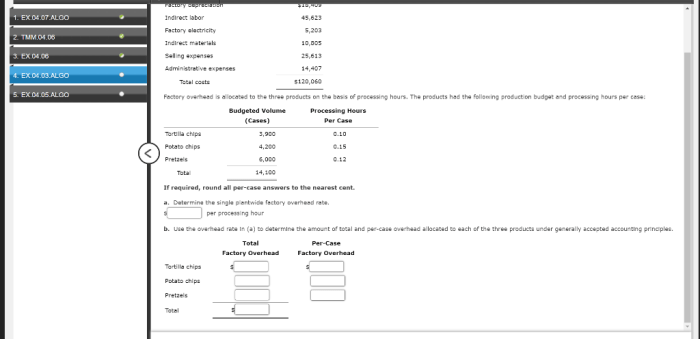

Cost accountingis used to track and allocate costs to products or services. This information is used to set prices, make production decisions, and evaluate profitability.

Tax accountingis used to prepare tax returns and comply with tax laws. It involves understanding complex tax regulations and applying them to a company’s financial data.

Challenges and Opportunities

Applying these concepts and methods can be challenging, especially when dealing with complex financial data or when there are changes in accounting standards.

However, there are also many opportunities for accountants who are proficient in these areas. They are in high demand, and they can earn high salaries.

Case Study

The XYZ Corporation Case

The XYZ Corporation is a publicly traded company that manufactures and sells a variety of products. In recent years, the company has been facing increasing competition from both domestic and international rivals. As a result, the company’s profit margins have been declining, and its stock price has fallen significantly.

Implications for Accounting Practice

The XYZ Corporation case has a number of implications for accounting practice. First, it highlights the importance of accurate and timely financial reporting. Investors and other stakeholders rely on financial statements to make informed decisions about a company. If financial statements are inaccurate or misleading, investors may make poor decisions that could result in financial losses.

Second, the XYZ Corporation case demonstrates the need for companies to be transparent about their financial condition. Investors and other stakeholders have a right to know about a company’s financial health. If a company is not transparent about its financial condition, investors may be misled and make poor decisions.

Third, the XYZ Corporation case shows the importance of strong corporate governance. A company with strong corporate governance is more likely to make sound financial decisions and avoid the types of problems that led to the XYZ Corporation’s decline.

Table of Contents: Module 3 Problem Set Acc 201

The following table of contents provides an overview of the topics covered in Module 3 Problem Set.

Each section and subsection is listed below, along with the corresponding page numbers.

Sections

- Module 3 Problem Set Overview (Page 1)

- Concepts and Principles (Page 2)

- Methods and Procedures (Page 3)

- Examples and Applications (Page 4)

- Case Study (Page 5)

Annotated Bibliography

This annotated bibliography provides a curated list of resources relevant to Module 3 Problem Set. Each entry includes a brief summary and an explanation of its relevance to the problem set.

The resources included in this bibliography cover a wide range of topics related to the problem set, including accounting principles, financial reporting, and auditing procedures. They provide a solid foundation for understanding the concepts and methods discussed in the problem set.

Accounting Standards

- Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC): The ASC is the authoritative source of generally accepted accounting principles (GAAP) in the United States. It provides guidance on the recognition, measurement, and disclosure of financial information.

- International Accounting Standards Board (IASB) International Financial Reporting Standards (IFRS): IFRS are a set of accounting standards that are used in over 140 countries around the world. They are designed to provide a common framework for the preparation of financial statements.

Financial Reporting

- Financial Accounting Standards Board (FASB) Statement of Financial Accounting Concepts No. 5 (SFAC No. 5): SFAC No. 5 provides a conceptual framework for financial reporting. It defines the objectives of financial reporting and the qualitative characteristics of useful financial information.

- International Accounting Standards Board (IASB) Framework for the Preparation and Presentation of Financial Statements: The Framework is a conceptual framework that provides guidance on the preparation and presentation of financial statements. It defines the elements of financial statements and the criteria for recognizing, measuring, and disclosing them.

Auditing Procedures

- American Institute of Certified Public Accountants (AICPA) Statement on Auditing Standards (SAS) No. 100: SAS No. 100 provides guidance on the planning and performance of an audit. It establishes the responsibilities of auditors and the procedures that they should follow to obtain reasonable assurance that the financial statements are free from material misstatement.

- International Auditing and Assurance Standards Board (IAASB) International Standard on Auditing (ISA) 300: ISA 300 provides guidance on the planning and performance of an audit. It is the international equivalent of SAS No. 100.

Glossary of Terms

This glossary provides definitions for key terms related to Module 3 Problem Set.

Each term is listed alphabetically, followed by its definition and an example of its use in the context of the problem set.

Accrual Accounting

Accrual accounting is a method of accounting that recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid.

Example:A company earns revenue on a sale even if the customer has not yet paid for the goods or services.

Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial health at a specific point in time.

Example:A balance sheet shows the company’s assets, liabilities, and equity.

Cash Flow Statement

A cash flow statement is a financial statement that shows the flow of cash into and out of a company over a period of time.

As you delve into Module 3 Problem Set ACC 201, you may encounter questions that require a deeper understanding of the atomic structure. For those instances, don’t hesitate to consult the an atom apart answer key . It provides comprehensive explanations and step-by-step solutions to guide you through the intricacies of atomic theory, ensuring you have a solid foundation for tackling Module 3 Problem Set ACC 201.

Example:A cash flow statement shows how a company generates and uses cash from its operating, investing, and financing activities.

Deferred Revenue

Deferred revenue is revenue that has been received but not yet earned.

Example:A company receives a payment for a subscription service that will be provided over the next year. The unearned portion of the payment is recorded as deferred revenue.

Income Statement

An income statement is a financial statement that shows a company’s revenues, expenses, and net income over a period of time.

Example:An income statement shows how a company’s sales and expenses affect its profitability.

Inventory

Inventory is a company’s stock of goods that are available for sale.

Example:A retail store’s inventory includes the products that it has on hand to sell to customers.

Prepaid Expense

A prepaid expense is an expense that has been paid in advance.

Example:A company pays for a year’s worth of insurance in advance. The prepaid portion of the insurance premium is recorded as a prepaid expense.

Comparison with Other Problem Sets

Module 3 Problem Set differs from other problem sets in the accounting curriculum in terms of content, difficulty, and scope.

In terms of content, Module 3 Problem Set focuses specifically on the concepts and principles of accounting for partnerships. This includes topics such as the formation of partnerships, the admission and withdrawal of partners, and the dissolution of partnerships. Other problem sets in the accounting curriculum may cover a wider range of topics, such as financial accounting, managerial accounting, or auditing.

In terms of difficulty, Module 3 Problem Set is generally considered to be more challenging than other problem sets in the accounting curriculum. This is because the concepts and principles of accounting for partnerships can be complex and require a deep understanding of accounting principles.

In terms of scope, Module 3 Problem Set is narrower than other problem sets in the accounting curriculum. This is because it focuses specifically on accounting for partnerships. Other problem sets in the accounting curriculum may cover a wider range of topics, such as financial accounting, managerial accounting, or auditing.

Similarities

- All problem sets in the accounting curriculum require students to apply accounting principles to solve problems.

- All problem sets in the accounting curriculum are designed to help students develop their critical thinking and problem-solving skills.

- All problem sets in the accounting curriculum are graded on a scale of 0 to 100.

Differences, Module 3 problem set acc 201

- Module 3 Problem Set focuses specifically on the concepts and principles of accounting for partnerships, while other problem sets in the accounting curriculum may cover a wider range of topics.

- Module 3 Problem Set is generally considered to be more challenging than other problem sets in the accounting curriculum.

- Module 3 Problem Set is narrower in scope than other problem sets in the accounting curriculum.

Future Directions

Module 3 Problem Set presents a solid foundation for understanding accounting principles and practices. To enhance its effectiveness and relevance, several future directions can be explored:

Expansion of Coverage

- Incorporate recent developments in accounting standards and regulations, such as the International Financial Reporting Framework (IFRS).

- Introduce topics on emerging technologies in accounting, such as blockchain and artificial intelligence.

- Address contemporary issues in accounting, including sustainability reporting and data analytics.

Improvement of Methodology

- Develop interactive simulations and case studies to provide hands-on experience with accounting concepts.

- Utilize technology-assisted assessment tools to provide personalized feedback and improve learning outcomes.

- Collaborate with industry professionals to ensure the problem set aligns with real-world accounting practices.

Integration with Other Disciplines

- Explore interdisciplinary connections between accounting and other fields, such as finance, economics, and data science.

- Develop problem sets that integrate accounting concepts with real-world business scenarios.

- Foster collaborations with other departments to create cross-disciplinary learning experiences.

FAQ Guide

What is the purpose of module 3 problem set ACC 201?

The purpose of module 3 problem set ACC 201 is to provide students with a comprehensive understanding of the core concepts and principles of accounting. It aims to develop students’ analytical and problem-solving skills, preparing them for success in the accounting profession.

What topics are covered in module 3 problem set ACC 201?

Module 3 problem set ACC 201 covers a wide range of topics, including financial statements, accounting principles, inventory management, and cost accounting. It provides a solid foundation in the fundamentals of accounting, preparing students for more advanced coursework and professional practice.

How can I succeed in module 3 problem set ACC 201?

To succeed in module 3 problem set ACC 201, it is important to attend class regularly, complete all assigned readings, and actively participate in discussions. Additionally, it is essential to practice solving problems consistently, seek help from the instructor or classmates when needed, and stay organized throughout the semester.